Shutterstock

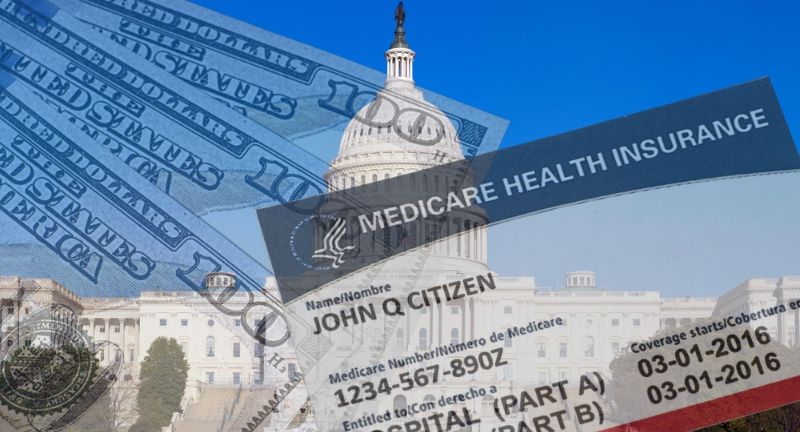

Medicare and Social Security are teetering on the brink, but a new lifeline has emerged, pushing their bankruptcy dates further into the future. This unexpected extension offers a fleeting sigh of relief for millions of Americans relying on these crucial programs. However, the underlying issues remain a ticking time bomb demanding urgent reforms. The clock is still ticking, and without decisive action, the reprieve may be short-lived.

Medicare Depletion Date Extended

Shutterstock

Medicare’s go-broke date for its hospital insurance trust fund has been pushed back five years to 2036. This extension is largely due to higher payroll tax income and lower-than-expected expenses from the previous year. Medicare covers over 66 million people, primarily those aged 65 and older. Despite the extension, the need for sustainable policy changes remains critical to avoid future financial shortfalls.

Social Security’s Future

Shutterstock

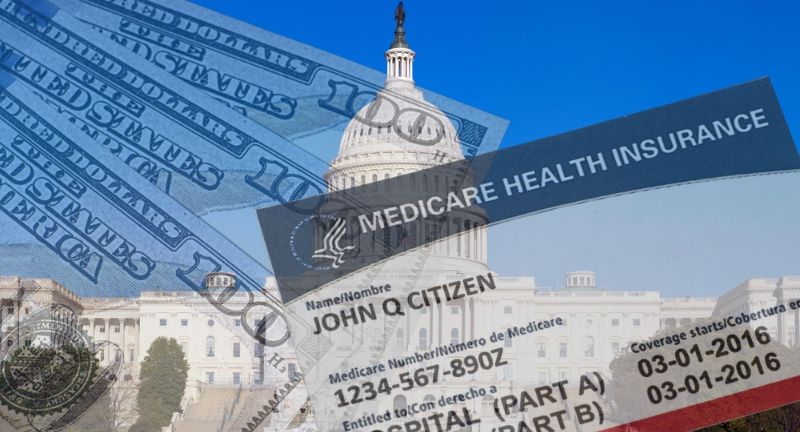

Social Security’s trust funds are now projected to be unable to pay full benefits starting in 2035, a slight improvement from last year’s estimate of 2034. This adjustment provides a brief reprieve but highlights the ongoing need for legislative action. Without intervention, Social Security will only be able to pay 83% of benefits. Lawmakers must address this issue promptly to protect the benefits of millions of Americans.

Impact on Beneficiaries

Shutterstock

The delay in depletion dates for Medicare and Social Security means beneficiaries will continue to receive full benefits for a longer period. This is particularly important for the 71 million people who rely on Social Security and the 66 million covered by Medicare. However, without significant reforms, future beneficiaries may face reduced benefits. Ensuring the sustainability of these programs is crucial for the well-being of current and future retirees.

Policy Changes Needed

Shutterstock

Despite the improved projections, experts warn that substantial policy changes are necessary to ensure the long-term viability of Medicare and Social Security. Proposals include increasing payroll taxes, adjusting benefits, and raising the eligibility age. Policymakers must act decisively to implement these changes and secure the financial future of these essential programs. Failure to do so could result in significant benefit cuts in the coming decades.

Economic Factors

Shutterstock

The improved economic outlook has contributed to the extended depletion dates for Medicare and Social Security. Higher payroll tax income and lower-than-expected expenses have played key roles in this positive development. However, the economic factors that influence these projections are subject to change. Continuous monitoring and adaptive policy measures are essential to maintaining the stability of these programs.

Political Implications

Shutterstock

The future of Social Security and Medicare is a significant political issue, particularly during election years. President Biden and former President Trump have both highlighted their plans for these programs in their campaigns. Biden has proposed raising taxes on high earners, while Trump has indicated openness to benefit cuts. The political discourse around these programs will significantly impact their future direction.

Public Opinion

Shutterstock

Public opinion strongly supports maintaining the current level of benefits for Medicare and Social Security. According to a March 2023 poll, most U.S. adults oppose cuts to these programs and favor raising taxes on the wealthy to ensure their sustainability. This sentiment underscores the importance of these programs to the American public. Policymakers must consider these views when proposing changes.

Historical Context

Shutterstock

The last major reform to Social Security occurred roughly 40 years ago, when the federal government raised the eligibility age from 65 to 67. Medicare’s eligibility age has remained unchanged at 65. These historical reforms were crucial in extending the solvency of the programs. Today, similar bold actions are needed to address the looming financial challenges.

Medicare Advantage

Shutterstock

Medicare Advantage plans have influenced the financial outlook of Medicare. These plans, run by private insurers, offer an alternative to traditional Medicare and have seen growing enrollment. The latest report indicates changes in how Medicare Advantage rates are accounted for, contributing to lower projected expenses. This highlights the role of private plans in the broader Medicare ecosystem.

Role of Congress

Shutterstock

Congress plays a pivotal role in determining the future of Social Security and Medicare. Legislative action is needed to implement reforms that ensure the programs’ sustainability. Bipartisan cooperation will be essential to navigate the political complexities and enact effective policies. The decisions made by Congress will directly impact millions of Americans who rely on these benefits.

Financial Projections

Shutterstock

The annual trustees report provides critical financial projections for Medicare and Social Security. These projections are based on numerous economic factors and assumptions. While the current projections are more optimistic, they underscore the need for proactive measures. Accurate financial forecasting is crucial for planning and implementing necessary policy changes.

Impact on the Economy

Shutterstock

Medicare and Social Security have significant impacts on the overall economy. These programs support consumer spending by providing income and health coverage to millions of beneficiaries. However, their financial challenges contribute to the national debt. Balancing these programs’ benefits with fiscal responsibility is essential for economic stability.

Future Outlook

Shutterstock

The future outlook for Medicare and Social Security remains uncertain. While the new depletion dates offer some relief, long-term solutions are still required. The ongoing political and economic developments will play a crucial role in shaping these programs’ future. Continuous vigilance and adaptive policies are essential to ensure their sustainability.

Conclusion

Shutterstock

The revised depletion dates for Medicare and Social Security provide a temporary reprieve, but they do not eliminate the urgent need for reform. Policymakers must act decisively to implement changes that ensure the long-term sustainability of these critical programs. Public opinion strongly supports maintaining benefits, emphasizing the importance of these programs to millions of Americans. As the political debate continues, the future of Social Security and Medicare remains a top priority for the nation’s well-being.